this post was submitted on 15 Apr 2024

1918 points (97.5% liked)

A Boring Dystopia

13523 readers

514 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

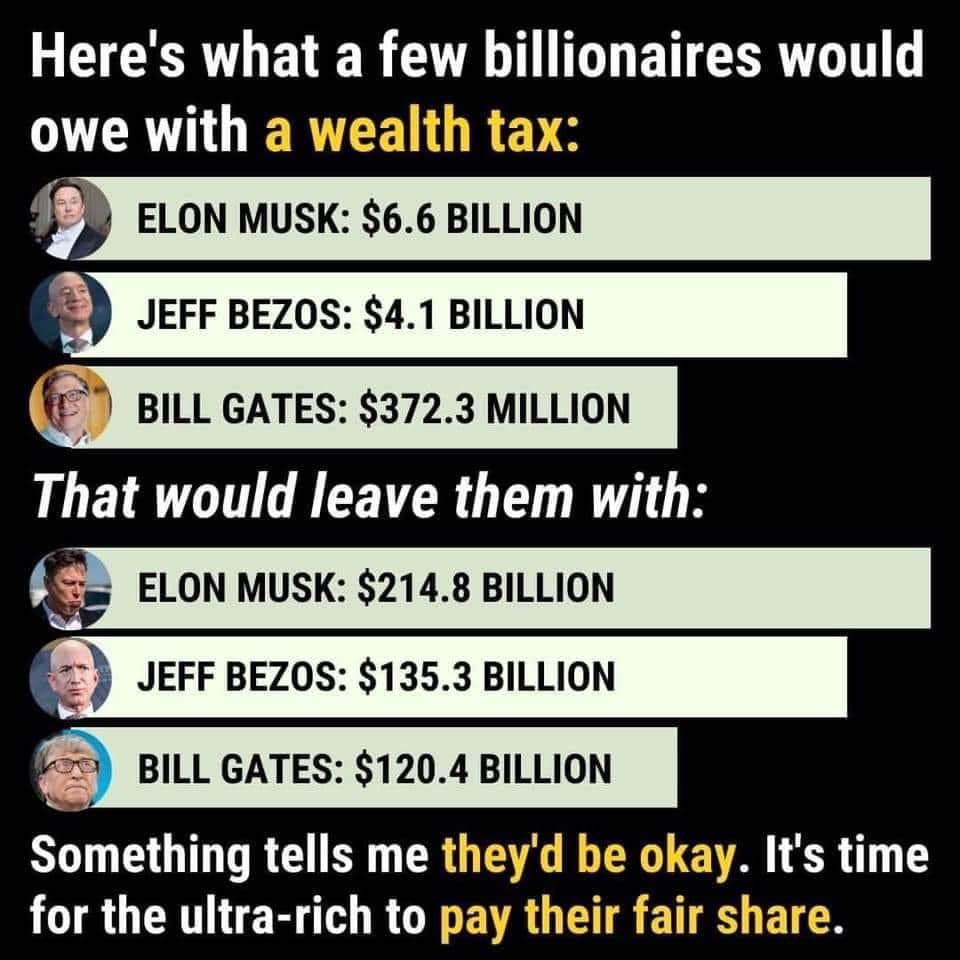

Why take so little? I would recommend a 80% tax bracket above £1b.

You mean like what we had during the 1940s–50s when the wealthy were taxed 90% (here in the US)? The tax rate the Baby Boomers started off with? We barely survived that time of massive economic expansion the first time around, Preposterous!

Personally, I would say anything over $100 million (or £ if you wish) should be taxed at 99%.

No one even nees $100 million, so that's being quite generous.

Are you counting actual money or just the value of assets?

And the value of the assets is defined by whom?

If only there were ways to value assets for tax purposes.

Too bad that's 100% impossible.

The deal with wealth is that it's not income. Wealth is income accumulated over time.

So is your 80% top bracket rate a one time thing, or every year?

One time when the tax is first introduced, then per year on all income that increases wealth beyond £1b.

Why not? No one can accumulate that much money without exploitation.

The thing is that in the presence of wealth taxes, wealth dis-accumulates exponentially in the same way that it accumulates exponentially without the tac.

So you end up needing much lower percentage rates on wealth to get the same effect as an 80% tax on marginal income. Wealth tax rates as low as single % would dramatically alter the distribution of wealth.