this post was submitted on 15 Apr 2024

1918 points (97.5% liked)

A Boring Dystopia

12706 readers

128 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

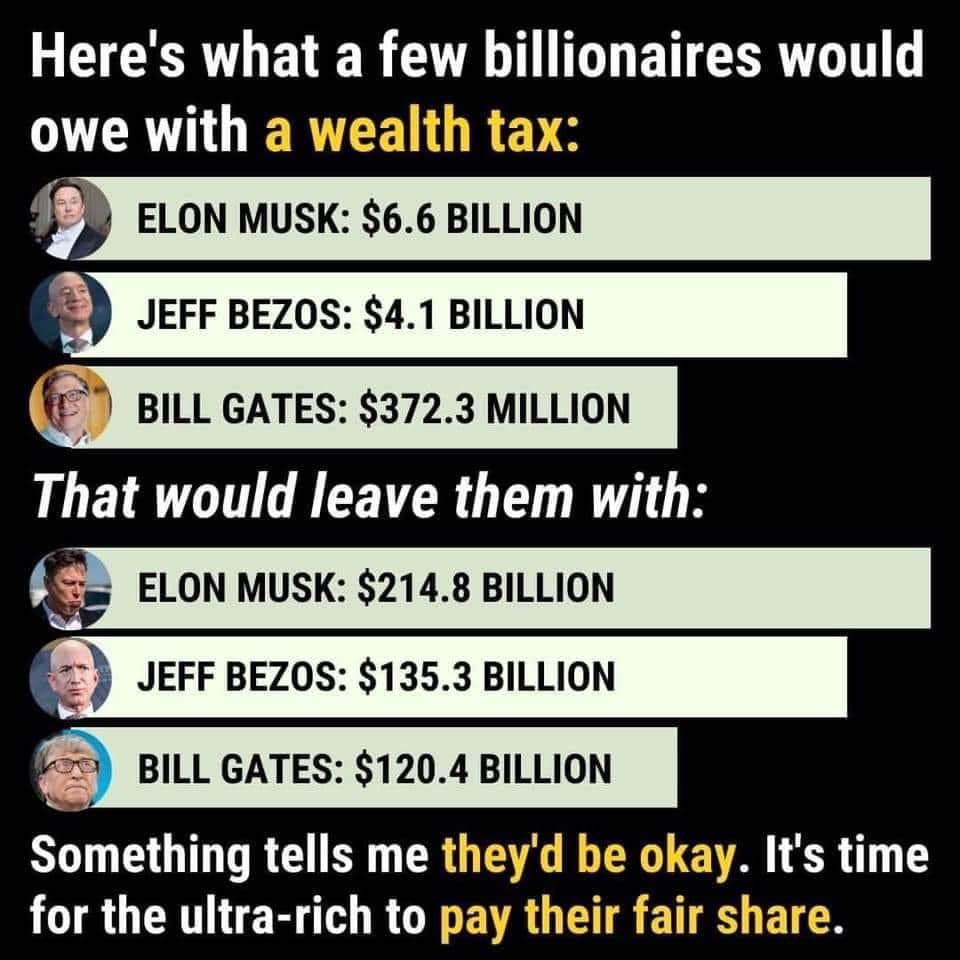

I don't really understand what is being advocated for, here. Are we taking away their stock shares? Because 214.8 Bn is absolutely not the liquid assets of Elon Musk.

You can't buy a house or car with unrealized gains. Are we going to start taxing everybody's unrealized gains annually or what is the effective bracket?

Ya'll gotta be more specific and shit. Let's just tax realized gains, and any loan collaterals based on the stocks, at exceptionally high rates? Or maybe have a very high bracket to justify taking unrealized gain stocks. That feels like it would be way easier than some vague bullshit that could harm consumers more than billionaires.

You're mostly right here, except stocks are an asset you can take a loan against with a margin loan or a line of credit. I suggest if you are doing that it SHOULD count as realized gains because you absolutely can use such a loan to buy a house, a car, a yacht, an island in the South Pacific, or an aircraft carrier.

Okay but if you take out a loan then you need to repay the loan with income which is taxed, so...

It's already being taxed...

That said it's probably being taxed at a lower rate due to the 2016 reform adding tax breaks for said circumstances and being able to have a lower annual income over the duration of the loan, so I definitely advocate for tax reform that undoes the damage by the GOP at least.

Yeah it's taxed at a much lower rate. Short term capital gains is a real bitch. Long term isn't so bad unless you're liquidating a lot... Like enough to buy a house or car or something we are discussing now. Over 450k ish is taxed 20%, but you can get a margin loan for 3 to 12 percent AND it's tax deductible lol.

Really, if you aren't rich with stock you are getting F-ed in the A...

Edit: I misread, I though it was saying "if you aren't rich with stock you aren't going to be F-ed in the A by an unrealized gains tax" but it was actually saying "If you're not rich with stocks then you're currently being F-ed in the A by our tax system"

If a hypothetical unrealized gains taxed passed today then there is a chance of poor people getting F-ed in the A, especially people with retirement funds or Vanguard share/portfolios. There is even a chance it hurts the poorer 80% more than the richer 20%.

The 2016 Tax Reform is a great example of that, it got tons of support from poor people and middle class and in the end it fucked them all in the A.

Depends on the structure. If it's 3% on value over 5 million, then the bottom 95% will not even have a dent. If it is paid by even average retirement funds, but funds more expensive Medicaid or your kids college education, you still win. It all depends on the details.

I suppose there might be some sell off to cover the tax bills if the wealthy, but it probably wouldn't shake the markets too much.

Sorry I misread your comment before I responded.

NBD, I saw this first actually.

You can repay a loan with money from a different loan. And they only just need enough money to cover the interest. For most of them the repayment doesn't come until they die and even then they pull as many tricks as possible to make it look like their estate is worth less than it is. Either way the amount of money these guys live off of is a tiny percentage of their entire wealth. 100M loan for a new mansion? That's not even 0.05% of Elon's wealth. Even $1 billion is a lot of fucking money. I don't care how illiquid your wealth is, if it's over $10B you're just hoarding it and it's doing fuck all for the economy.

Okay but that doesn't justify taxing all unrealized gains for everyone, does it? Just tax the rich, or add laws against perpetual refinance without income.

Sidenote: If Elon Musk could do such a convoluted scheme then he wouldn't have sold Billions of Tesla stock a couple of years ago and paid Capital Gains taxes in the billions. I believe with all my heart that Elon is such a POS that he would have absolutely wormed his way out of that sort of requirement if it were so easy.

Listen, Jim - how much do you realistically own in unrealized gains? It doesn't even matter to be honest - since you're shit posting on the Internet, I wouldn't put your net worth much higher than $10-20 million - and that's me being an absolute philanthropist, in terms of how much "benefit of the doubt" I'm willing to afford an Internet shit poster.

Even if you were somehow blessed to have more than that - you still wouldn't qualify as one who needs to pay this kind of wealth tax.

Where'd you get the idea that it would "tax all unrealized gains"?

For just stocks mine is a pretty lowly $6,198 USD right now, National Average according to Federal Reserve Data says $87,000 Median and $333,945 Mean.

You said:

But that's not what the meme says at all. The meme says nothing except that unrealized gains should be taxed. That's not good enough, you need to be more specific.

The Vast Majority of US Citizens do not have adequate retirement savings, and we've got this Meme saying a 2.98% annual unrealized gains tax is a solution to problems? We need to be a lot more specific about when and how this tax works if we want to avoid harm.

That wealth is primarily invested in businesses that function within the economy, so "doing fuck all for the economy" is literally a lie, and this act is literally the opposite of "hoarding".

The business can survive just fine having more owners, each with a smaller piece of the pie. Yes, you lose majority control but boo hoo on still being filthy rich.

You, uh, don't think maybe more of those unrealized gains should go to the actual workers? What the fuck?

Do the "actual workers" also pay up if the business suffers losses, then?

Can't have it both ways.

Yeah, they tend to get laid off. That's having it both ways.

Part of the problem is there are shell games around the repayment. I thought this could be handled by any use of the stock as collateral should count as a 'sale' for tax purposes, and any taxes on those proceeds that would be "double taxed" as folks are so afraid of can be offset by tax credits if the loan is 'properly' repaid in a normal way. So if you loan but repay normally, ok, you gave the government a '0% loan', but you are still "fairly" taxed other than that, and the 0% loan is a small price to pay for access to your wealth.